Skyrocketing GameStop Stock Best Thing for Stock Market

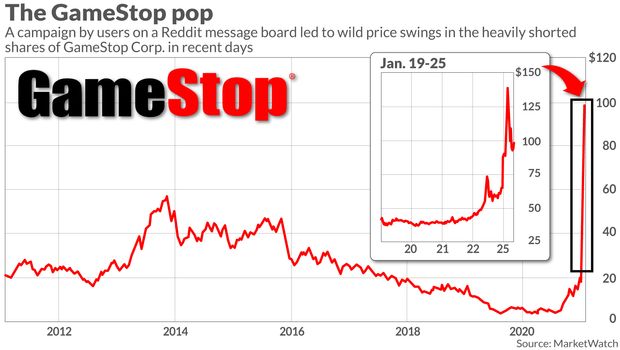

Photo courtesy of marketwatch.com

Gamestop share value from 2012 to 2021

March 5, 2021

In recent months short selling stocks has become even more profitable than before due to the value of many stocks going down in price.On Jan 12, GameStop stock was selling at $19.95 per share, two days later it was selling at $39.91 per share and by Jan 27 it peaked at $347.51 per share. As of March 1, it has gone down to $104.54 per share. The prices of stocks are results of supply and demand, so that when more people want the stock it will sell for more. Usually the price of a company’s stock will go up when a company is successful and the price will go down when the company is failing.

There is also another way to make money in the stock market that’s different than betting on a company’s success. Short sellers will profit off a company stock going down by essentially borrowing stock and promising to pay back the stock at a later date but for whatever the value of one share is when you have to pay it back. Doing this is profitable but risky since there is no cap to how much money one can lose by short selling. Short selling is very lucrative as it is a multi-trillion dollar industry.

Redditors on the subreddit r/wallstreetbets noticed the large amount of GameStop stock shares that people had been short selling, and organized for people to buy as much GameStop stock as they can which drives up the price of the stock. This means that the short selling companies will be losing money on GameStop stock. In the days that redditors were driving up the price shorts, sellers were having to pay back the stock they borrowed at $20 and pay back upwards of $300 per share. Overall short selling companies lost upwards of $13 billion dollars in just less than two weeks.

The redditors have done what many have tried to do but failed, as they redistributed the enormous wealth of the millionaires on Wall Street to the pockets of the people. They did exactly what the free market is supposed to do by getting rich off of the unstopped risky investments of the multi-billion dollar industry. By doing this they haven’t just made themselves rich but they also showed people that the rich are not untouchable, and that it can be as simple as a popular Reddit post to hit the wealthy hard and help the poor.

This isn’t fully about the money though. The redditors are giving the rich that are gambling with people’s life savings a reminder that the general population is the reason that they are rich. Hopefully this will be a wake up call for the stock brokers and hedge funds that they can’t exploit the hard work of the people just for a profit. Realistically they probably won’t change their ways and life will go back to normal for them.

The money made from the sudden inflation is not just going into the pockets of people that will store it away in their bank account either. According to CNN A mechanical engineering student, Hunter Kahn, made $30,000 off GameStop stock and with that money he decided to donate game consoles to a children’s hospital. Whereas hedge fund managers might have to sell off one of their boats or cars after the sudden increase in share prices.

Unfortunately, all good things must come to an end. On Jan 28, Robinhood decided to stop the buying of GameStop stock, causing the price to start going down, which is ironic for a company named Robinhood with the slogan “democratize finance for all”. Though they will get to pay people back as they are facing over 30 class action lawsuits from frustrated app users. At least the people know who cares about them and who cares about keeping the rich people’s betting money safe.